As I sit down to fill in my tax return I’m looking for any distraction. This year in France, it’s compulsory to do it online. Aurelia and Carina have their own business managers in Roma Nova with some poor souls in their office tasked to complete the wretched things.

Anyway… My mind wandered off to thinking about how the ancient Romans were taxed. Today we have income tax, company/corporation tax, sales taxes/VAT, excise duties (car tax (UK), alcohol, cigarettes), local taxation, inheritance tax, to name but a few. But how similar are our taxes to theirs?

Globally, taxation under the Roman Empire was about 5 percent of gross product. Individuals typically paid from 2 to 5 percent. The tax code was complex; direct and indirect taxes, some paid in cash and some in kind (hopefully not weeks’ old fish). Taxes might be specific to a province (read local authority/state), or special types of property such as fisheries or salt evaporation ponds (rateable value).

Tax revenue in Rome had one principal object – to maintain the military. Taxes in kind were accepted from less-monetised areas, especially if it was grain, animals or goods supplied to army camps.

The primary source of direct tax revenue was, unsurprisingly, individuals, who paid a poll tax (ha!) plus a tax on their land (rates/council tax), construed as a tax on its produce or productive capacity (business tax).

Supplemental forms could be filed by those eligible for certain exemptions; for example, Egyptian farmers could register fields as fallow (set aside) and tax-exempt depending on flood patterns of the Nile (tax credits).

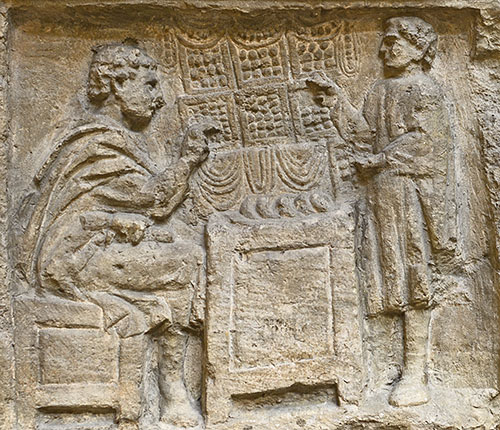

The amount of tax payable was determined by the census, which required each head of household to make a declaration to the censor’s official and provide a head count of his household. He (and almost exclusively ‘he’) also had to account for property he owned that was suitable for agriculture or habitation.

Read Lindsey Davis’ adventure “Two for the Lions” about the room for abuse and, although we love Falco, how tax collectors could make a not un-useful fee for this work.

Read Lindsey Davis’ adventure “Two for the Lions” about the room for abuse and, although we love Falco, how tax collectors could make a not un-useful fee for this work.

A major source of indirect-tax revenue was the portoria – customs and tolls on imports and exports – including among provinces.

Special taxes were levied on the slave trade. Toward the end of his reign, Augustus instituted a 4 percent tax on the sale of slaves, which Nero shifted from the purchaser to the dealers, who responded by raising their prices. An owner who manumitted a slave paid a “freedom tax”, calculated at 5 percent of value. (No legal modern equivalent, TG, but it does have echoes of stamp duty on property transactions.)

Inheritance tax of 5 percent was levied when Roman citizens above a certain net worth left property to anyone but members of their immediate family (inheritance tax). Revenues from the estate tax and from a one percent sales tax on auctions went toward the veterans’ pension fund (aerarium militare).(How sensible – MOD, please note.)

Low taxes helped the Roman aristocracy increase their wealth, which globally equalled or exceeded the revenues of the central government. An emperor sometimes replenished his treasury by confiscating the estates of the “super-rich”, but in the later period, the resistance of the wealthy to paying taxes was one of the factors contributing to the collapse of the Empire. (A chilling lesson for modern times which we would do well to take notice of.)

So the principle and methodology of taxation were two more things the Romans did for us. If we’re not careful with the one in the last paragraph, it may do for us as well.

Alison Morton is the author of Roma Nova thrillers – INCEPTIO, PERFIDITAS, SUCCESSIO, AURELIA, INSURRECTIO and RETALIO. CARINA, a novella, and ROMA NOVA EXTRA, a collection of short stories, are now available. Audiobooks are available for four of the series. NEXUS, an Aurelia Mitela novella, is now out.

Download ‘Welcome to Roma Nova’, a FREE eBook, as a thank you gift when you sign up to Alison’s monthly email newsletter. You’ll also be first to know about Roma Nova news and book progress before everybody else, and take part in giveaways.

fascinating information. Thank you!